Income Tax Slabs 2026: New Tax Regime vs Old Tax Regime – Which One Is Better?

After the latest updates in 2026, understanding the difference between the New Tax Regime and the Old Tax Regime is very important. Whether you are a salaried employee, freelancer, or business owner, choosing the right tax regime can help you save more money.

At Taxoreo we regularly provide updated information related to income tax, GST, and financial planning to help taxpayers make informed decisions.

In this blog, we will explain:

- Income Tax Slabs for 2026

- New Regime vs Old Regime comparison

- Example tax calculation

- Which regime is better for you

New Tax Regime 2026 (Section 115BAC)

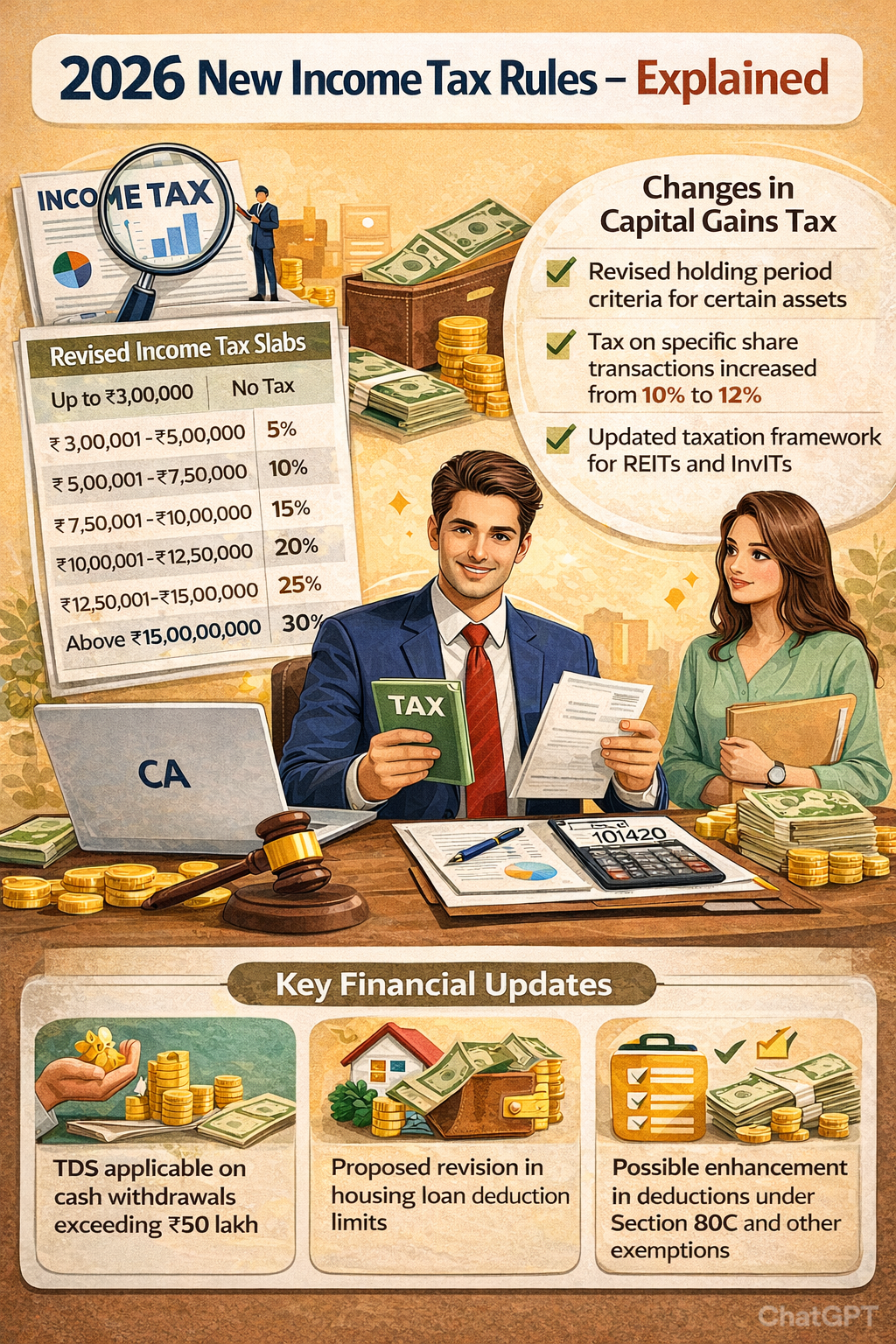

Under Section 115BAC, the New Tax Regime provides lower tax rates but limits most deductions and exemptions. New Tax Slabs 2026 (Individuals Below 60 Years)

|

Annual Income |

Tax Rate |

|

₹0 – ₹3,00,000 |

Nil |

|

₹3,00,001 – ₹6,00,000 |

5% |

|

₹6,00,001 – ₹9,00,000 |

10% |

|

₹9,00,001 – ₹12,00,000 |

15% |

|

₹12,00,001 – ₹15,00,000 |

20% |

|

Above ₹15,00,000 |

30% |

Key Features of New Regime

- Standard Deduction available (as per Budget updates)

- Most deductions like 80C, 80D, HRA are not allowed

- Simple tax calculation

- Default tax regime (if you don’t choose one)

Old Tax Regime 2026

The Old Tax Regime allows multiple deductions and exemptions but has slightly higher tax rates.

Old Tax Slabs 2026 (Individuals Below 60 Years)

|

Annual Income |

Tax Rate |

|

₹0 – ₹2,50,000 |

Nil |

|

₹2,50,001 – ₹5,00,000 |

5% |

|

₹5,00,001 – ₹10,00,000 |

20% |

|

Above ₹10,00,000 |

30% |

Major Deductions Available (Old Regime)

- Section 80C (Up to ₹1.5 lakh – LIC, PPF, ELSS, etc.)

- Section 80D (Health insurance premium)

- HRA Exemption

- Home Loan Interest (Section 24)

- LTA, Education Loan (80E), and more

New vs Old Tax Regime – Comparison Table

|

Feature |

New Regime |

Old Regime |

|

Tax Rates |

Lower |

Higher |

|

Deductions |

Limited |

Multiple |

|

Investment Needed |

No |

Yes |

|

Filing Complexity |

Simple |

Slightly complex |

|

Suitable For |

Low investment earners |

High deduction claimers |

Example Calculation (Annual Income ₹10,00,000)

Case 1: No Investments

- New Regime → Approx. ₹60,000–₹75,000 tax

- Old Regime → Higher tax

New Regime is better.

Case 2: ₹1.5L under 80C + ₹25K under 80D + HRA Claim

- Old Regime reduces taxable income significantly

- Final tax may become lower than New Regime

Old Regime may be better.

Which Tax Regime Should You Choose in 2026?

Choose New Regime If:

- You don’t invest much in tax-saving schemes

- You want simple tax filing

- Your income is ₹7–12 lakh with minimal deductions

Choose Old Regime If:

- You fully use 80C limit

- You have a home loan

- You claim HRA

- You pay insurance premiums

Important Points

- Rebate under Section 87A may apply depending on your income.

- Employees must inform employers about their chosen regime.

- Final selection can be made while filing your Income Tax Return ITR, subject to rules.

Final Conclusion

In 2026, the New Tax Regime is simple and beneficial for those with fewer deductions, while the Old Tax Regime is better for taxpayers who actively invest and claim deductions.

For more latest updates on Income Tax, GST and financial planning tips, visit: